Illinois has particular rules governing spousal maintenance, sometimes known as alimony. Spousal maintenance is intended to support a spouse who earns less or has reduced earning potential both during and after the divorce. Spousal maintenance in Illinois can be either provisional or permanent and is determined by a number of variables, such as the length of the marriage, each spouse’s salary and earning potential, and the style of life they had while they were married.

The period of spousal maintenance is determined as a proportion of the length of the marriage for weddings that lasted less than 20 years. Spousal maintenance may be permanent if the marriage lasted more than 20 years, but it may also be reduced or stopped if there has been a material change in circumstances.

The amount of spousal maintenance in Illinois is similarly calculated using a formula that takes into consideration the income of each spouse, the number of children involved, and any other financial responsibilities. This formula is only applied, though, if the parties’ total gross income is less than $500,000. The court will exercise its discretion to choose the amount of spousal support if the total gross income exceeds $500,000.

Ultimately, the purpose of spousal maintenance in Illinois is to offer financial assistance to a spouse who needs it while also taking into account the other spouse’s financial circumstances. The goal of Illinois’ spousal maintenance legislation is to make the decision-making process fair and equitable for all parties.

You May Want To Know: How To Avoid Paying Alimony

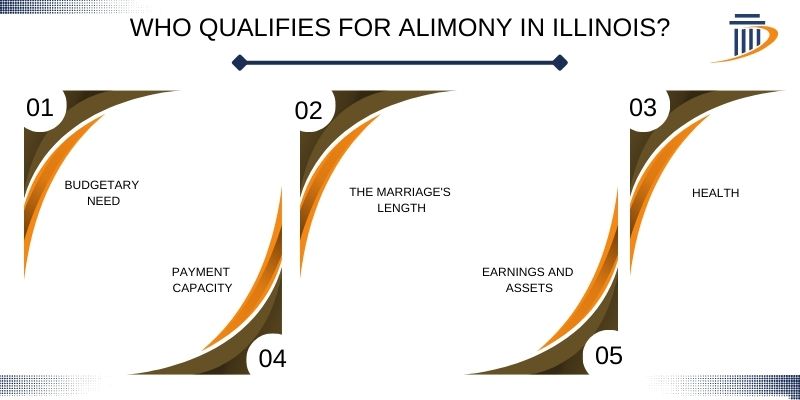

Who Qualifies For Alimony In Illinois?

To decide if one spouse is qualified to obtain spousal maintenance from the other spouse, the state has developed rules. In order to be eligible for spousal support in Illinois, one must fulfill specific legal requirements.

The requirements for spousal maintenance in Illinois are as follows:

Budgetary Need

The spouse requesting maintenance must demonstrate that they are unable to satisfy their reasonable demands without financial assistance from their ex-spouse. This can be done by demonstrating that they are unable to sustain themselves through gainful employment or other resources.

Payment Capacity

After taking into consideration their own acceptable living expenditures, the spouse who would be compelled to pay support must have the financial means to do so.

The Marriage’s Length

A significant aspect in evaluating eligibility for spousal maintenance is the length of the marriage. The duration of maintenance is normally set at half the length of the marriage if it lasted less than ten years. The length of maintenance may be greater for marriages that lasted more than ten years.

Earnings And Assets

The quantity and length of spousal maintenance are decided after taking into account the assets and income of both spouses. The level of living that was set during the marriage as well as each spouse’s ability to make an income will be considered by the court.

Health

Age and health of each spouse may also be taken into account when evaluating spousal maintenance eligibility. A spouse who suffers from health issues and is unable to work may be more likely to obtain maintenance.

How Does Alimony Work In Illinois And How To Avoid It?

In Illinois, the length of the marriage, the standard of living throughout the marriage, as well as the income, earning potential, and requirements of each spouse are all taken into account by the court before alimony is granted. According on the situation, the court may impose several types of alimony, such as interim or permanent alimony.

While permanent alimony may be granted for a longer period of time after the divorce is finalized, temporary alimony is often granted during the divorce proceedings. In the event that either spouse’s financial situation significantly changes, the court may potentially reduce or terminate alimony payments. The overall goal of alimony in Illinois is to guarantee that both spouses have stable finances following a divorce, and the court carefully evaluates each case to reach an equitable and reasonable conclusion.

In Illinois, there are some situations where paying alimony may be avoided. For instance, if both parties earn the same amount of money, or if the party requesting alimony engaged in adultery or other marital wrongdoing. The court may also lower or stop alimony payments if the party requesting alimony cohabits with a new spouse.

Related Article: What States Do Not Enforce Alimony?

FAQ’s

Is alimony mandatory in Illinois?

In Illinois, alimony is not necessary. The court has the discretion to choose whether to provide alimony and how much to award.

How many years do you have to be married to get alimony in Illinois?

In Illinois, there is no minimum amount of time spent married to be eligible for alimony.

Who pays alimony in a divorce Illinois?

In a divorce in Illinois, the spouse who earns more may be obliged to pay alimony.

Hi, I’m Brian Gary; I have my Doctor of Juridical Science (SJD) degree from SMU Dedman School of Law in Dallas. Over the years, I have dealt with many families and successful corporate Legal cases. I have counseled many people on legal matters, and along with my profession, I write about Law on my blog. Please feel free to contact me for counseling/case discussion; I’ll be happy to help you.